Debt Management For Businesses: Strategies For Managing Debt

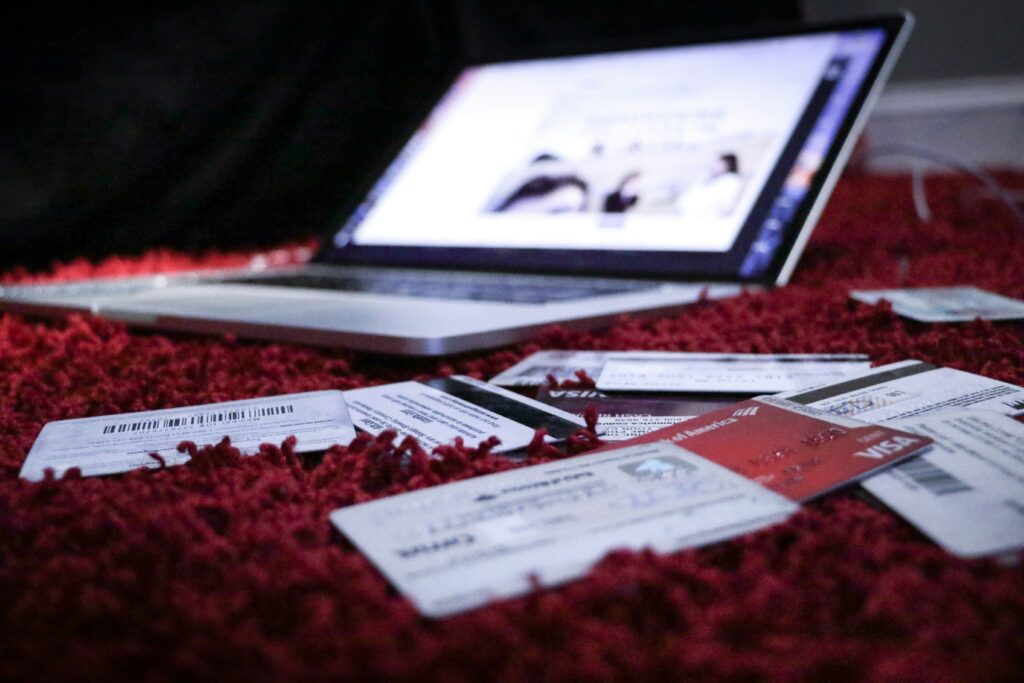

Managing debt is an important aspect of running a successful business. As a business owner, it’s crucial to have a solid understanding of debt management for business strategies to ensure that your business remains financially healthy. With the right strategies in place, you can manage your debt effectively and reduce the risk of financial instability. In this blog, we’ll explore top strategies for effective debt management. Learn how to reduce current debt and prevent future accumulation for long-term success.

Define Debt Management for Business

Debt management for business is the process of reducing or paying off debts. It involves a lot of different steps and things to do, like negotiating with creditors for a lower interest rate, making a budget, or giving discounts to get more sales. Basically, it’s anything you do to reduce, reorganize, or get rid of your financial obligations.

4 Reasons Why Companies Get Into Debt

Businesses get into debt for many different reasons, both inside and outside the company. As a business owner, you should learn about these things so you can figure out how to avoid them.

1. A Dry Market Season

The dreaded “off-season” can have a big impact on businesses. As soon as the busy time is over, things slow down and eventually stop. Smaller companies take out loans to keep their business going when they lose money.

2. A Lack of Plans

Failure to do financial planning can lead to poor decisions. For instance, if a company wanted to make a new product, it would have to find out what customers want, how it works for them, and how much it will cost to make.

If it doesn’t plan out these important details, it might not make much money. And no matter how useful the product is, it won’t be much help if it doesn’t make money. Worse, it can cause the company to lose money and go into debt.

3. Bad Management of The Cash Flow

In order to manage cash flow, you need to know how much money is coming into and going out of your business. Make sure you know where they came from and where they are headed. When businesses don’t do this, problems can arise that can hurt their ability to make money. If a business doesn’t keep track of its cash flow well, it may have to take out more loans to pay for the ones it already has.

Effects of The Economic Downturn

A slow economy or recession can cause less money to come in. And when bigger companies enter the market, it can put smaller ones out of business. Small businesses often finance their business activities and use other types of loans to keep their finances stable and avoid losing a lot of money.

Strategies For Managing Debt As a Business Owner

Debt can be a useful tool for starting a business and making it grow. In fact, one of the most common ways to fund a business is through a small-business loan. Even if the debt is necessary, though, it is still important to keep a close eye on it. Small and medium-sized businesses in particular need to be careful with their debt if they want to stay profitable. We’ll talk about how to handle debt effectively below.

Review Your Debts And Put Them in Order Of Priority

The first step in solving any problem is to make people aware of it. So, when putting debt management strategies into place, your business should first look at all of its debts. These things could be:

- Any bank loans or overdrafts

- Any business credit cards, as well as the interest rates and monthly payments

- Lease agreements or agreements

- liabilities related to employees, such as wages, benefits, pensions, or benefits for people who have already retired.

- Taxes on business

After you’ve looked over your debts, you can start to put them in order of importance. Which debts have the worst consequences for being paid late? For example, if you can’t pay your workers, that puts the whole team in danger.

Check out the budget for the business

How much do you know about the financial state of your company? When did you last look at the budget again? As your business grows and changes, it makes sense to make changes to your budget to give yourself more room to breathe.

A good budget should list all of your sources of income, as well as your fixed and variable costs. You can also include a cash flow forecast to better plan for transactions that aren’t in your P&L. Your budget’s main goal is to help you get into the habit of setting aside money to pay suppliers, employees, creditors, and other debts. The key to managing your debt and other parts of your business is to review and update your budget as your business changes.

Ways to Enhance Cash Flow for Business

Effective cash flow management is crucial for any business’s long-term success. Slow collections can make it challenging to meet financial obligations, even if revenue is coming in. To ensure timely debt payments and free up funds, it’s important to implement cash flow management strategies. Start by creating a cash flow forecast as part of your budget and reviewing your accounts payable and accounts receivable processes. These strategies can help you better manage your cash flow and maintain a healthy financial position for your business.

Examining Loan Conditions

As a business owner, it’s important to review the terms of your existing loans to ensure that they are still competitive. Refinancing your loans can be a valuable opportunity to restructure your debt and make it more manageable. Consolidating multiple loans into one source or adjusting their duration to better suit your business needs can make a significant difference. By taking the time to review and optimize your loan terms, you can free up cash flow and reduce financial stress, positioning your business for greater success in the long run.

Lower Business Expenses

If your company is having trouble keeping a healthy cash flow and, as a result, is having trouble making debt payments, you need to either boost sales or cut expenses, with the latter usually being simpler. Start by calculating your total business expenditures for the last six months. After that, identify ongoing costs like rent, utilities, subscriptions, or software fees. Costs should be added together, then multiplied by 10%. Then, decide how you might reduce your business expenses by that amount. Your greatest debt priorities can then be paid off using the money that has been released.

Increase Revenue

When your business is doing well, you might put too much emphasis on top-line sales and ignore areas where you’re losing money. When you do a profitability review, you can find pricing problems, customers who have stopped buying, and services and products that aren’t selling well. When you pay more attention to how profitable your business is, you can find ways to make more money. And, of course, when you make more money, you can pay off your debts more easily.

Consider a Debt Payment Plan

A plan for paying off your debt won’t solve all of your problems (like having to keep track of how much debt you’re getting), but it can save you money on interest. There are two common ways to pay off debt faster:

- The debt avalanche strategy is to pay more on the debt with the highest interest rate and only the minimum on all other debts.

- The debt snowball strategy means to start by paying off the smallest debts. Once those are paid off, keep making the same amount of payments towards the bigger debts. By giving the same payment amount to other debts, you’re basically acting as if the smaller debt was never paid off.

Both plans have good points and bad points. If you don’t know how to pay off your debt or how much extra debt payments your business can afford, these are great accounting jobs. To get your business back on track, you might want to give your accounting team the tasks of debt management or, if necessary, bring in an outside consultant.

The starting point for effective debt management, as is the case with each of these suggestions, is financial visibility. You can get the financial visibility required to make wise organizational decisions by increasing awareness in all areas of your firm and by performing regular reviews.

Conclusion:

Managing debt is critical for business success. By implementing effective debt management strategies, businesses can improve their financial stability, increase cash flow, and build a strong credit profile. Seeking professional advice from a reputable CPA firm like Stepanchuks CPA can be invaluable in creating a customized debt management plan. With the right guidance. You can take control of your business finances and achieve long-term success. For more information on debt management for businesses, please visit Stepanchuks CPA.

Editor’s Choice: