Scale Your Business: The Essential Processes and Tools

Smart Growth and Scaling your business is a goal that many entrepreneurs aspire to achieve. It requires careful planning, preparation, and execution. And, that is only possible with standard operating procedures and tools. Entrepreneurs like you can streamline operations, increase efficiency, and reduce costs with these. Businesses need certain processes and tools to grow. Using these processes and tools can help a business reach its growth goals.

The Importance Of Smart Growth For Businesses

Businesses need smart growth to grow sustainably, satisfy customers, stay competitive, and stay financially stable. Funding, efficiency, people, management, and retaining customers are all challenges when scaling up a business. Successful growth requires strong leadership, careful planning, and a dedication to constant improvement.

Small businesses can succeed with the help of chatbots, CRM, ERP, inventory management software, email automation, and social media automation tools. These tools can assist with customer service, customer relationships, operations, and taking on extra work. With the right tools and strategies, businesses can achieve their growth goals.

The Benefits of Smart Growth for Businesses

Smart growth is about expanding a business in a sustainable way for the future.

A. Improved productivity:

Businesses be more productive by improving efficiency and cutting costs. This can be done by streamlining operations and using technology to automate tasks. This can lead to higher productivity levels, which can support growth and profitability.

B. Enhanced client satisfaction:

Businesses can increase customer loyalty and satisfaction by developing products and services that meet customer preferences and providing excellent customer service. Repeat customers and good word-of-mouth can help a business become more successful. This can lead to more business and increased profits.

C. Increased profitability:

Businesses make more money by operating efficiently, marketing effectively, and managing finances well. It can also reduce costs, increase sales, and manage cash flow in a way that promotes growth.

D. Competitive advantage:

Businesses become more sustainable, please customers, and be more efficient by growing in a smarter way. It can help bring in new customers, keep current ones and help the business grow and make more money in the long run.

Essential Processes for Scaling Up Your Business

In order to scale your business, you must first assess your preparedness. Is your infrastructure in place to handle exponential growth? Have you made the necessary preparations to ensure success?

Start by determining your fixed costs and ongoing expenses. Forecast your economic end game and the steps needed to reach your goals. How much revenue will you need to break even? How long will it take to significantly improve cash flow and how much funding will you need?

These are important questions to consider for the future of your business. With a growth mindset and vision, you can create a strong basis for success.

Scalability ensures that processes remain consistent regardless of growth or size.

Here’s how it should be done.

1: Make a system that works well

Talent alone is rarely enough to make a business grow. It needs a plan and the right tools. Keep core processes stable and predictable, and fill gaps to improve scalability. Analyze efficiency, costs, quality, and performance to make changes for better scalability.

2: Get capital and use it well

To fund your business, you need to find investors who believe in you. To do this, you need to present a solid business plan and financial model. Examine systems for growth and international expansion and determine how to generate revenue.

3: Leverage Automation

Finding investors and automating processes is key to growing a business. Asset management systems help streamline processes, reduce losses, and improve employee satisfaction. A CRM system can also help improve efficiency and bring in new business.

4: Build A Solid Foundation

Invest in tech to make business processes more efficient and scalable. Choose pay-as-you-grow platforms or SaaS services instead of stand-alone platforms to save money and reduce maintenance.

5: Find and keep the best people.

Strategic asset management requires more than just physical resources; people are key. Ensure you have the right technology to support your growth and the right people to fill new roles. Use technology to shift the focus from everyday tasks to developing leadership.

Expert opinions on scaling up

Verne Harnish and Michiel Muller are both experts in scaling up businesses and organizations, and they both emphasize the importance of essential processes in this endeavour.

Verne Harnish, in his book Scaling Up and in his talks, emphasizes the importance of having the right processes in place to support growth and expansion. He identifies four areas of focus for scaling up: people, strategy, execution, and cash. Within each of these areas, he emphasizes the importance of having clear processes and systems that can be scaled up as the organization grows.

Michiel Muller, the founder, and CEO of multiple successful companies know how important processes are for scaling. He stresses the need to create a plan and execute it in a structured manner in uncertain situations. To support growth, he believes the right processes need to be in place to adapt to changing circumstances.

These experts agree that essential processes are critical for scaling up successfully and that organizations must prioritize the development and optimization of these processes as they seek to grow and expand.

Tools for Scaling Up Your Business

Technology helps startups and growing businesses save money, speed up processes and improve quality. In 2022, project management, customer relationship management, automation, data analytics, cloud infrastructure, communication and collaboration, and security are the best tech tools fo .business growth.

Here are 8 top Tools for Scaling Up

-

CRM-Hubspot

HubSpot CRM is a great tool for improving customer experience and marketing. It offers features like tracking emails, companies, contacts, deals, and tasks, free team invite, an easy-to-use dashboard, automated contact updates, a drag-and-drop communicator, and marketing workflows. It’s free to use, but add-ons start at $50/user/month.

-

Communications – Slack

Say goodbye to intercompany emails and hello to Slack. Slack offers teams a single place to communicate and collaborate with integrations, channels, and mobile-friendly features. Pricing starts at $6.25/user/month.

-

Sharing Information and Getting Trained – Whale

The Whale helps teams collaborate more efficiently by giving them easy access to data, rules, and expertise. It stores this data in one place, allowing teams to be more productive.

-

Project Management – Trello

Trello is the perfect tool for managing tasks and meeting deadlines. Organize projects with Kanban and Scrum boards, set deadlines, and track progress. Free with limited functionality and starting at just $5 per user per month.

-

Traction Tools: Make meetings count

Traction Tools helps entrepreneurs run powerful, transformative meetings with no silos or confusion. Pricing starts from $149/month for up to 10 users. Our team at Whale loves the results!

-

Bookkeeping: Quickbooks

Quickbooks by Intuit® is the most popular small business accounting software. Gleam helps you track cash flow, get business insights, track expenses, customize invoices and generate reports easily and affordably. Plans start from as little as $15 per month.

-

Password Security with LastPass

Quickbooks and LastPass are essential for scaling businesses. Quickbooks is a business transaction, bill payment, and payroll software. LastPass is a password manager and generator that provides secure storage for passwords and personal information. It can generate secure passwords, audit existing passwords, and is accessible via Chrome Extension, mobile, and web. It also has affordable pricing.

-

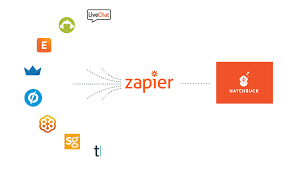

Zapier Automation

Zapier is an online tool that helps you set up automated processes without coding. It works with over 3,000 apps and services. Pricing starts at $19.99/mo.

Common Mistakes Businesses Make When Scaling Up

Scaling up a business can be difficult. Businesses often make mistakes while doing so. Here are some of the most common mistakes businesses make when scaling up:

1. Weak sales and marketing process to start with

If your business doesn’t have a strong base, you won’t have anything to build on. So, if you want to grow, you need to make sure you have enough customers and a good plan for growth. Start by putting together your marketing funnel. This will help you lay the groundwork.

2. Unpredictable Revenue Model

Not every business model is prepared for fast growth. Business owners should accept advice to overcome challenges and grow. This will make sure that the business is ready to attract more customers and make more money.

3. Bad ways of hiring

Companies often hire people who aren’t good enough to meet their business prospects. This, in turn, makes it hard for the business to grow. So, a person should be hired based on his or her skills, knowledge, and number of years of work experience.

4. A bad team in charge

Entrepreneurs will have trouble scaling up if they don’t change the way they lead as they grow. You can’t lead a group of people to do their best work if you don’t have the right skills.

In fact, growing a business starts with having leaders with the right kind of vision.

5. Getting too big too fast

It is very silly to think that growing quickly will give you a good return on investment. Scaling a business takes time and should be done carefully. It is important to ensure that the business is growing in a strategic way. If you grow too quickly, it could hurt your business.

Businesses can reach success in the long run by making a plan and avoiding mistakes. Businesses that plan strategically and avoid common mistakes can achieve long-term success.

How Stepanchuk CPA Can Help Businesses Grow Smart

Stepanchuk CPA is a firm that offers a range of services to growing businesses. Some of their key services include:

Accounting and Bookkeeping:

Stepanchuk CPA provides accounting and bookkeeping services to help businesses manage their finances. These services include financial statement preparation, monthly bookkeeping, and tax preparation.

Tax Planning and Compliance:

Stepanchuk CPA offers tax planning services. These services help businesses reduce their taxes and meet regulations.

Business Advisory:

Stepanchuk CPA provides business advisory services that can help growing businesses make strategic decisions. These services include financial analysis, budgeting and forecasting, and cash flow management.

Audit and Assurance:

Stepanchuk CPA offers audit and assurance services to growing businesses. These services include financial statement audits, reviews, and compilations.

Outsourced CFO Services:

Stepanchuk CPA offers outsourced CFO services that can help growing businesses manage their financials more effectively. These services include financial reporting, forecasting, and analysis.

Stepanchuk CPA assists businesses with financial management, future planning, and growth.

Benefits of working with Stepanchuk CPA

Working with Stepanchuk CPA offers several benefits for small businesses, including:

Expertise: Stepanchuk CPA employs experienced professionals who are knowledgeable in accounting, finance, and tax planning. They provide advice and assistance to businesses to help them make sound financial decisions.

Time and cost savings: Stepanchuk CPA can save small businesses time and money by managing their accounting and finance tasks. This allows businesses to focus on their main operations and plans for growth.

Strategic planning: Stepanchuk CPA can help small businesses. Financial performance can be analyzed to gain insight, areas for improvement can be identified, and plans can be created to reach growth goals. This will help create a strategic plan for growth.

Tax planning and preparation: Stepanchuk CPA helps small businesses with their taxes. They provide tax planning and preparation services. They ensure the business follows tax laws and regulations and reduce the amount of taxes due.

Financial coaching: Stepanchuk CPA provides financial coaching to small business owners. It provides knowledge about finances and guides them to make better financial decisions.

Stepanchuk CPA helps small businesses to be successful. They give expert advice, save time and money, and make plans to help their clients achieve their goals.

Client success stories

Looking for an accounting firm that can help you handle your taxes and finances effectively? Stepanchuk CPA is the answer! But don’t just take our word for it, here are some success stories from our satisfied clients:

Nichola, the owner of Pacific Touch NYC, highly recommends Stepanchuk CPA to anyone in need of top-notch accounting services. She regards Iryna as her mentor and depends on her for guidance and support.

Jonathan, from Black Back & Back Creative, praises Iryna and her team for their hard work, diligence, and expertise in streamlining their bookkeeping and tax strategy. He highly recommends them for their excellent work.

J&R Photography also has great things to say about working with Iryna. They describe their experience as seamless, efficient, and hassle-free. Iryna checks their finances regularly and checks in with them. They appreciate her accountability and professionalism, which has impressed them.

At Stepanchuk CPA, we take pride in providing excellent service and support to all of our clients. Contact us today to schedule a call and learn how we can help you succeed in your business.

Conclusion

Scaling up a business requires careful planning and the implementation of essential processes and tools. Having a strong financial foundation, efficient systems, and scalable processes will ensure success in the long-term. Our team of experienced professionals can provide tailored solutions to meet your unique needs, whether it’s through financial planning and analysis, tax planning, or business strategy.

Editor’s Choice: