Nothing Compares 2 Entities Like Taxes

Nothing Compares 2 Entities Like Taxes – Chapter 5 Of ISCPA’s Tax Savings E-Book

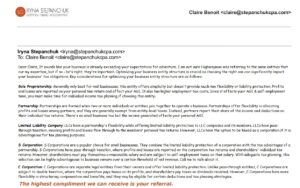

Highwayman said everything started with entities. My head spun with possibilities of what that could mean. He also mentioned my CPA Iryna; as random as it seemed – I emailed her for clarity and she replied. I had asked her if she somehow knew what entities Highwayman had been referring to. She expressed doubt that they communed with the same entities, but ultimately concurred that nothing compares 2 entities like taxes.

Her email had a lot of information; my takeaway was that a sole proprietorship might be simplest for me on the frontend but regrettable when the taxes rolled in. I was as uncertain about a partnership as I was about Googie. Both the LLC and S-Corp were intriguing and required further discussion to see which might be most suitable and advantageous for me. I scheduled a call with her coordinator to discuss things further. At least business entities would be sorted, thanks to Iryna.

“Stop the car!”

Googie broke suddenly from his trauma bond with his phone. “Look up, we almost missed it.”

With all that had happened in a short span of time, we’d almost missed a key stop along our route – The Mojave Trails National Monument. I parked my car in an area that appeared to be designated for vehicles. A shooting star fell in the distance just as I got out to stand beneath the clearest view of the milky way I’d ever seen.

“I think the entities we’re looking for have got to be here.” Googie said with a smile that reminded me of how I had fallen in love with him, once upon a foolish time.

I let the memory pass. Instead, taking in the beauty of the present moment and accepting that what I was looking for had already found me.

“So – aliens, angels… ghosts, or something else? What do you think will find us here Googie?” Since he seemed to be on a winning streak with being right, I asked him.

“Well, I’m only sure of one thing finding us here – right now.” He said, moving closer to me.

“What’s th-”

Googie’s kiss stopped my questions as my mind reeled in the infinite unknown that surrounded us within and without. I wasn’t sure that Googie and I were being found by the same thing. But I had a certain feeling that both of us were being watched.

Did You Enjoy This Chapter Of ISCPA’s Upcoming Free E-Book To Save Business Owners Like YOU Tens-Of-Thousands Of Dollars On Your Taxes?

Stay tuned as there’s more to come, with far greater insights and tips. If you’d like to be among the first to receive a FREE copy of this e-book in it’s entirety when it is available – subscribe to our newsletter. The e-book will contain top–secret content from Iryna’s “leaked” emails. We will also be doing a giveaway related to the completed book’s title.

Additionally, If you’re a business owner who would like to save a massive amount of money on your taxes this year, and possibly recoup overpayments from previous years, schedule your free consultation today.