CCPA Compliance Checklist

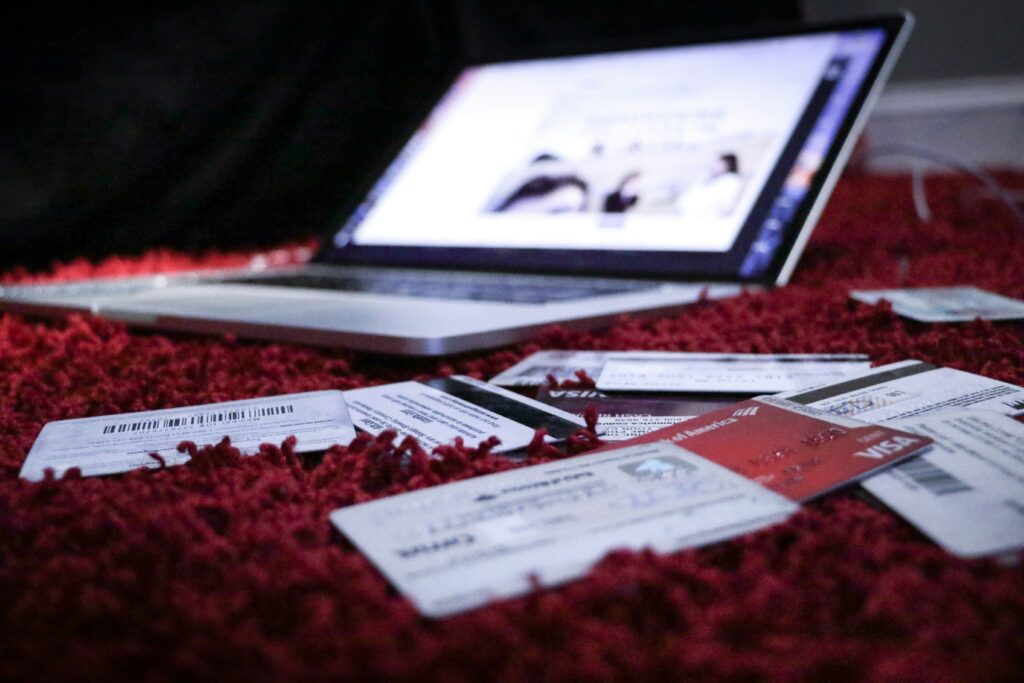

In this article, we will provide a comprehensive checklist for modern businesses to ensure compliance with the California Consumer Privacy Act (CCPA). We will discuss the importance of complying with CCPA regulations and provide an overview of the law.

Understanding CCPA Compliance

The California Consumer Privacy Act (CCPA) takes a broader approach than the General Data Protection Regulation (GDPR) regarding what constitutes sensitive data by including any data that can be related to an unnamed individual or household.

Key components of the CCPA

Firstly, the CCPA gives consumers the right to ask a business to disclose any of the following:

- All data collected about the consumer

- What kinds of sources are used to gather this information

- Why a company would want to collect or sell that information

- The information is shared with third parties

In this case, the term “business purpose” means:

- Transactions that need auditing or checking

- Keeping an eye out for security problems, fraud, or illegal activity

- Debugging to find and fix mistakes

- Use only for a short time.

- Providing services on behalf of the business or service provider

Section 1798.135 of the California law says that businesses must put a form on their websites asking customers if they consent to sharing their information. Otherwise, you can be taken to court if your customers aren’t aware of how their information was collected.

The following are other rights that consumers have:

- Right to remove

- Right to say no to selling their information for any reason.

- Right to not be treated differently for exercising rights

- Right to data portability

- Businesses that need to comply with CCPA

- Penalties for non-compliance

Penalties for breaking the CCPA

As of January 1, 2020, businesses in California must respond to any verified consumer request under the CCPA within 45 days. If they fail to address a violation within 30 days of notification, the California Attorney General may impose a maximum penalty of up to $7,500 for each violation. Furthermore, if there is an unauthorized breach of data, consumers can recover damages up to $750 per violation through a private right of action. In contrast, GDPR has a tiered system for fines depending on the severity of the violation. Therefore, the penalty can be 4% of the global annual turnover from the prior year or $20 million; or 2% of the global annual turnover or $10 million – whichever is greater in either scenario.

Not complying with these regulations are puts you at risk of facing litigation. The high number of privacy litigations in California was among the driving factors behind the CCPA, as Alastair Mactaggart and others were concerned about the tracking and profiling of California consumers.

Comprehensive CCPA Compliance Checklist

The California Consumer Privacy Act (CCPA) is a comprehensive privacy law that grants California residents the right to access and control their personal information held by businesses. To comply with CCPA, businesses need to take several steps to ensure they are protecting consumer privacy.

Here is a CCPA compliance checklist with details on what businesses should do:

-

Understand CCPA:

As a business owner, you must understand the scope and requirements of CCPA, including what personal information is covered, who is subject to the law, and what consumer rights are granted.

-

Identify Personal Information:

Businesses must identify the personal information they collect, use, and disclose, including data collected from customers, employees, and vendors.

-

Update Privacy Notices:

Businesses must update their privacy notices to include the categories of personal information they collect, the purposes for which they use that information, and the rights of consumers under CCPA.

-

Provide Opt-Out Options:

Businesses must provide consumers with a clear and conspicuous way to opt-out of the sale of their personal information.

-

Respond to Consumer Requests:

Businesses must establish procedures for handling consumer requests to access, delete, or opt out of the sale of their personal information.

-

Train Employees:

Businesses need to train their employees on CCPA requirements, including how to handle consumer requests and protect personal information.

-

Implement Security Measures:

Implement reasonable security measures to protect personal information from unauthorized access or disclosure.

-

Review Service Provider Agreements:

You must review your service provider agreements in order to verify that your vendors are also CCPA compliant.

-

Verify Age:

Businesses that collect personal information from minors must verify their age and obtain consent from their parents or guardians.

-

Update Data Retention Policies:

You must establish and enforce data retention policies to ensure that personal information is not retained for longer than necessary.

This Comprehensive CCPA compliance checklist can help businesses comply with CCPA requirements and protect the privacy rights of California residents.

Conclusion

Modern businesses must protect the privacy of their consumers’ personal data. The checklist in this article can help businesses assess their current data practices and implement necessary changes for CCPA compliance. At Stepanchuk CPA, we offer professional services to assist businesses in achieving CCPA compliance and maintaining ongoing compliance with evolving data protection regulations. For more information, schedule a free consultation.